Easy Loans Ontario: Simplified Approaches to Financial Backing

Wiki Article

Unlock Your Financial Possible With Convenient Lending Solutions You Can Trust Fund

In the world of personal money, the availability of easy finance solutions can be a game-changer for people striving to open their economic capacity. As we explore the world of problem-free fundings and relied on services better, we reveal necessary insights that can encourage individuals to make informed choices and protect a secure monetary future.Benefits of Hassle-Free Loans

Convenient lendings provide debtors a efficient and structured method to gain access to monetary help without unnecessary complications or delays. In comparison, easy lendings prioritize rate and ease, giving consumers with rapid access to the money they require.

Moreover, convenient loans generally have very little eligibility requirements, making them easily accessible to a broader variety of individuals. Traditional lenders commonly call for comprehensive documentation, high credit history, or collateral, which can leave out several possible debtors. Problem-free financings, on the various other hand, concentrate on affordability and versatility, offering assistance to people who might not fulfill the strict requirements of typical economic organizations.

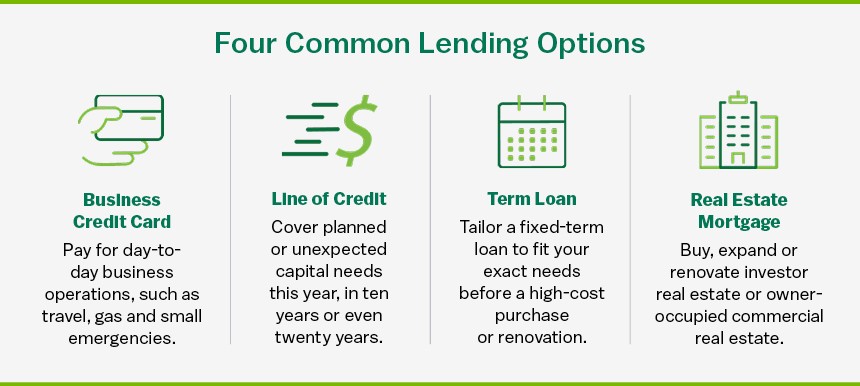

Sorts Of Trustworthy Funding Services

Just How to Get a Loan

Discovering the essential eligibility standards is vital for individuals seeking to qualify for a funding in today's financial landscape. Lenders usually evaluate numerous aspects when determining a borrower's qualification for a car loan. Among the primary factors to consider is the candidate's credit rating. An excellent credit scores rating indicates a background of liable economic behavior, making the customer less high-risk in the eyes of the loan provider. Revenue and employment status additionally play a significant function in the funding authorization process (loans ontario). Lenders need guarantee that the debtor has a steady earnings to settle the financing in a timely manner. In addition, the debt-to-income ratio is a critical statistics that lenders use to examine an individual's capability to handle added debt. Supplying current and accurate financial information, such as income tax return and bank declarations, is important when obtaining a funding. By understanding and meeting these qualification standards, individuals can enhance their possibilities of getting approved for a finance and accessing the economic help they need.Taking Care Of Car Loan Repayments Intelligently

When consumers efficiently secure a lending by meeting the key qualification requirements, sensible management of finance settlements comes to be vital for keeping financial security and credit reliability. Timely repayment is vital to avoid late costs, fines, and unfavorable influences on credit rating. To take care of loan settlements wisely, debtors need to produce a budget plan that includes the regular monthly settlement amount. Setting up automatic payments can help make sure that payments are made on schedule monthly. Additionally, it's a good idea to prioritize finance settlements to avoid falling back. In cases of financial problems, connecting with the loan provider proactively can often cause alternative repayment setups. Keeping an eye on credit score records frequently can also help debtors stay notified concerning their credit rating standing and recognize any type of inconsistencies that may need to be attended to. By managing finance repayments properly, borrowers can not just fulfill their financial responsibilities but likewise develop a favorable credit rating that can profit them in future economic ventures.Tips for Selecting the Right Loan Choice

Picking the most ideal financing alternative involves thorough research study and factor to consider of private monetary requirements and scenarios. Think about the financing's overall expense, settlement terms, and any additional fees associated with the loan.Moreover, it's vital to select a car loan that lines up with your economic objectives. For instance, if you need funds for a specific objective like home enhancement or financial debt consolidation, go with a finance that meets those needs. Additionally, read the financing arrangement very carefully, ensuring you understand all conditions before finalizing. Finally, look for advice from economic specialists if required to ensure you make an informed choice that fits your economic circumstances. By following these tips, you can confidently pick the appropriate finance alternative that assists you achieve your monetary purposes.

Conclusion

Finally, opening your monetary potential with easy funding services that you can rely on is a clever and liable choice. By understanding the benefits of these car loans, knowing just how to get approved for them, handling settlements sensibly, and choosing the ideal finance choice, you can attain your monetary objectives with self-confidence and comfort. Trustworthy financing services can offer the support you require to take control of your finances and reach your preferred end results.Secured loan ontario fundings, such as home equity car loans or cars and truck title loans, permit customers to utilize security to safeguard lower rate of interest prices, making them a suitable option for individuals with important possessions.When debtors efficiently safeguard a loan by satisfying the vital eligibility standards, sensible management of funding settlements ends up being critical for preserving monetary security and creditworthiness. By managing car loan payments properly, debtors can not just meet their monetary commitments but also construct a favorable credit report background that can profit them in future monetary ventures.

Consider the car loan's overall expense, repayment terms, and any kind of extra fees connected with the loan.

Report this wiki page